According to CBRE's 2025 Hotel Brand Performance report, the proliferation of brands has not necessarily equated to increased revenue per available room. Major hotel companies have expanded their brand portfolios at a 7 percent compound annual growth rate over the past decade. Despite this expansion, the anticipated boost in RevPAR has not materialized, with inflation eroding nominal gains. This article examines the impact of brand proliferation on RevPAR, the widening performance gap between brands, and the implications for hotel owners and developers.

Brand Proliferation and RevPAR

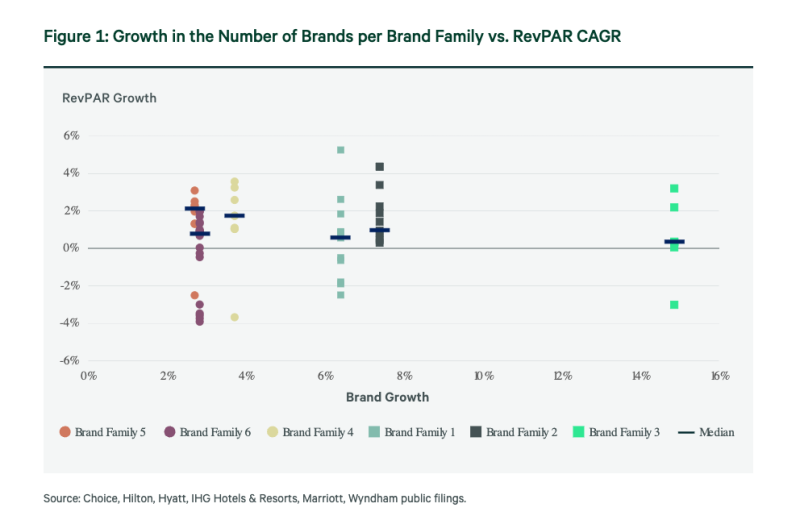

Adding more brands may mean broader reach, but doesn’t necessarily result in faster RevPAR growth. Major brand families have doubled their portfolios since 2014 to an average of 24 brands each in 2024. Loyalty program membership has increased at a 15 percent CAGR over the same period. However, since 2019, the fastest growing brand family by number of brands (15 percent CAGR) posted the slowest median RevPAR CAGR of just 0.3 percent. Although brand proliferation may drive loyalty member growth, our analysis suggests a negative correlation between brands and RevPAR growth within the same brand family.

Digging deeper, not all brand additions perform equally. Some, like glamping or all-inclusive resorts, may attract new customers and give loyalty members less traditional locations and experiences where they can redeem the more than $12 billion worth of loyalty points they’ve stored. Other brands, like middle-tier conversion or extended-stay brands, which increased by more than 40 percent over the past five years, are the most likely to fuel unit growth for franchisors at the risk of cannibalizing existing hotels.

Over the past five years, RevPAR has increased by a 1.8 percent CAGR, up by 20 basis points from the prior five-year period. However, this negligible growth is less than the rise in inflation, which increased by a 4.2 percent CAGR from 1.6 percent over the same two time periods. The net result is that despite nominal RevPAR increasing by 9.3 percent cumulatively, real RevPAR is 10.9 percent below 2019 levels after inflation. This suggests that shadow supply from alternative lodging sources and growth in traditional hotel supply are more than offsetting the demand recovery, resulting in reduced pricing power.

Performance Gap

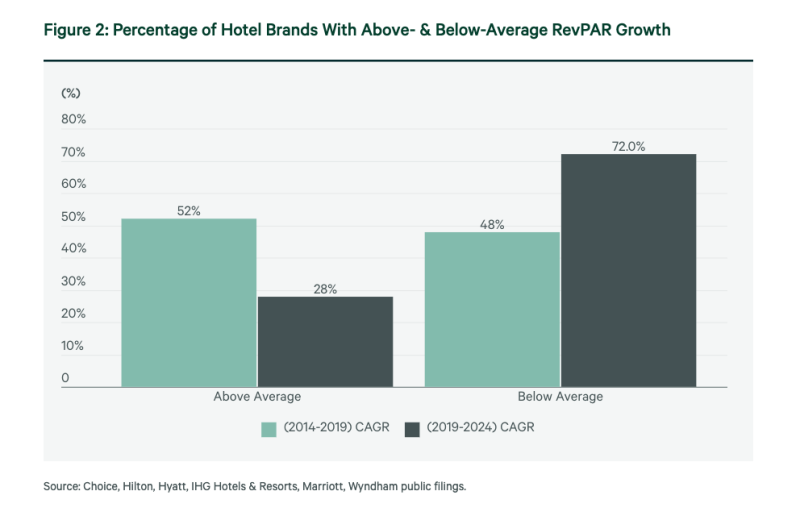

Between 2014 and 2019, 52 percent of brands posted RevPAR gains above the sample CAGR average of 1.6 percent; since 2019, that share has dropped to 28 percent of brands above the sample CAGR average of 1.8 percent. This means that brand selection is even more critical to profitability. The same is true even when controlling for chain scales. For example, the spread between the top- and bottom-performing luxury brands widened to nearly 7 percentage points between 2019 and 2024 from 5 points between 2014 and 2019. Over time, this divergence resulted in a 41 percent cumulative RevPAR premium for the strongest brand versus 29 percent in the earlier period.

Brand Family Impact

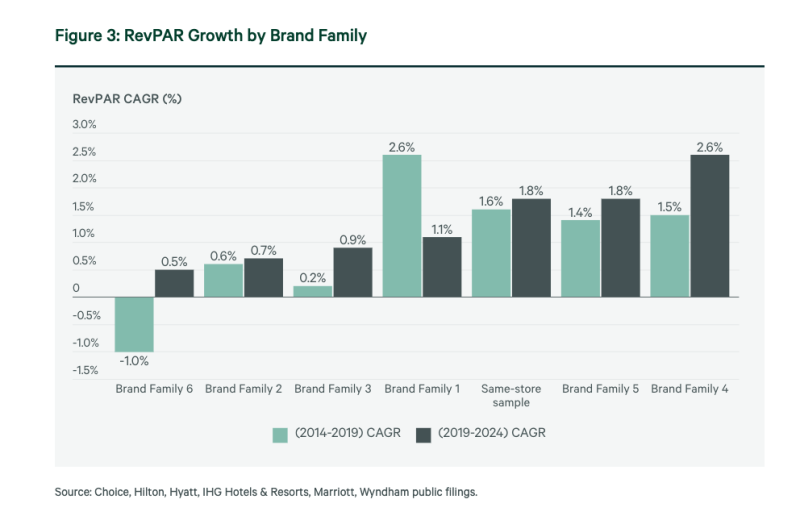

RevPAR performance varies significantly by brand family. The strongest brand family posted a 2.1 percent RevPAR CAGR from 2014 to 2024, while the weakest contracted by 0.2 percent. This 26 percent cumulative spread can significantly affect long-term investment returns and, depending on leverage levels, be the difference between profits and losses.

The difference is material no matter whether attributing it to the strength of the loyalty program, marketing efficiencies, standard operating procedures, the brand family’s halo effect or the quality of leadership.

What it Means for Owners and Developers

This analysis underscores the importance of thorough due diligence when selecting a brand or brand family. While brand affiliation can offer access to loyalty programs, favorable financing terms and operational efficiencies, the RevPAR performance of individual brands—and the consistency of that performance within a brand family—can meaningfully affect asset value over time.

With performance gaps widening and new brands continuing to launch, it is more important than ever to assess whether a brand’s positioning, fee structure and customer mix are well aligned to generate profits across cycles and throughout the franchise agreement.

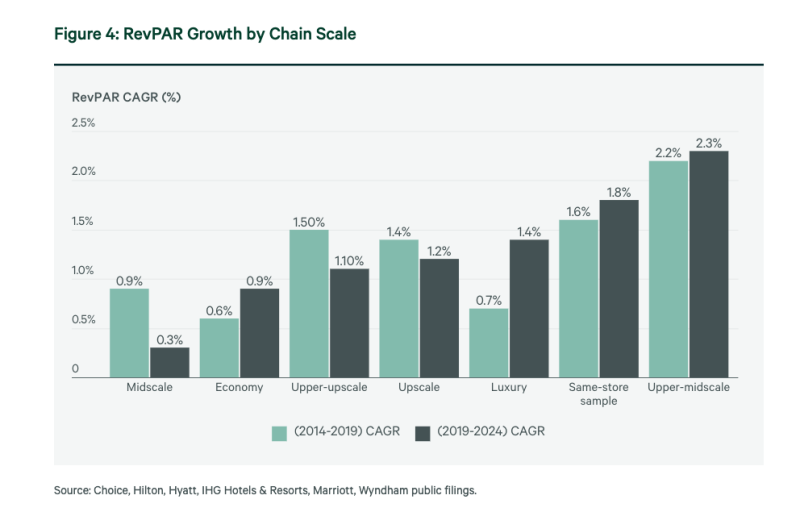

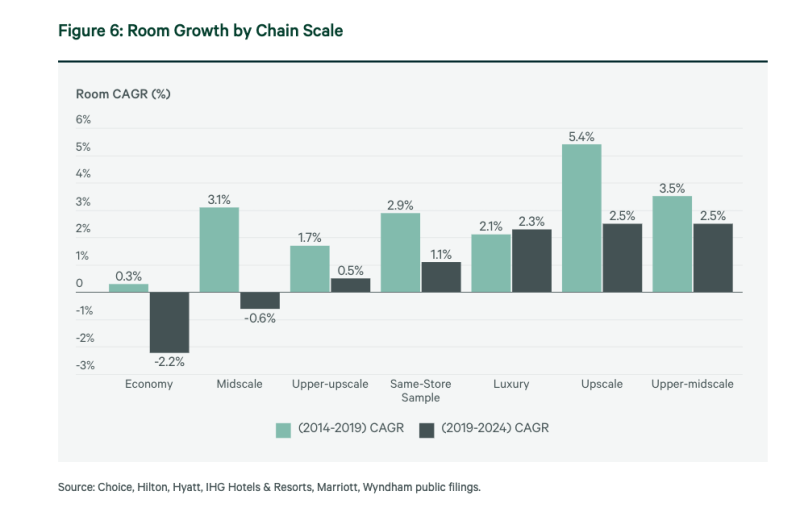

Chain Scale Trends: Upper-Midscale Outperforms

The upper-midscale segment continues to demonstrate resilience and was the top performer during both the pre-pandemic and post-pandemic five-year periods. Upper-midscale brands posted the highest RevPAR CAGR of any chain scale at 2.2 percent from 2014 to 2019 and 2.3 percent from 2019 to 2024. These properties benefit from strong brand recognition and simplified operations. Guests are attracted by the segment's lack of resort fees, which have increased at a 5.8 percent CAGR since 2015, according to CBRE’s Trends in the Hotel Industry data.

Upper-midscale properties also attract a flexible customer base that trades up or down in response to economic conditions, contributing to steady demand. Upper-midscale hotels have offered more predictable returns in uncertain times.

Guest Preferences

In the mid-tier segment, brands that offer complimentary breakfast consistently have occupancy rates that are 2 to 3 percentage points higher than those that don’t and had more than double the RevPAR growth over the past five- and 10-year periods. Based on data from CBRE’s Trends in the Hotel Industry, brands that offer complimentary breakfast had higher margins and less downside during the pandemic-induced contraction.

Although the data suggests that consumers value complimentary breakfast, it is less clear that the higher occupancies and higher RevPAR growth equate to higher gross operating profits, as guests who pay for breakfast drive higher overall ancillary revenues.

Low-Tier Segments

Midscale and economy chains are facing both RevPAR declines and closures. These two chain scales posted the slowest RevPAR growth between 2019 and 2024 and continued to decline recently, down by 1.9 percent in May for economy chains and 3.2 percent in April for midscale chains.

RevPAR declines in the midscale and economy chain scales are leading to hotel closures, which should ultimately bring supply and demand back in balance as non-performing properties are razed or converted to other uses. This will set up newer lean and efficient prototypes in these chain scales for improving topline and profitability.

According to CBRE, the hotel industry's current environment presents both challenges and opportunities. Brand proliferation has not led to the expected RevPAR growth, and the performance gap between brands is widening. Hotel owners and developers must conduct thorough due diligence and consider strategic brand alignment to navigate this complex landscape. Upper-midscale brands continue to outperform, offering a stable investment option in uncertain times.