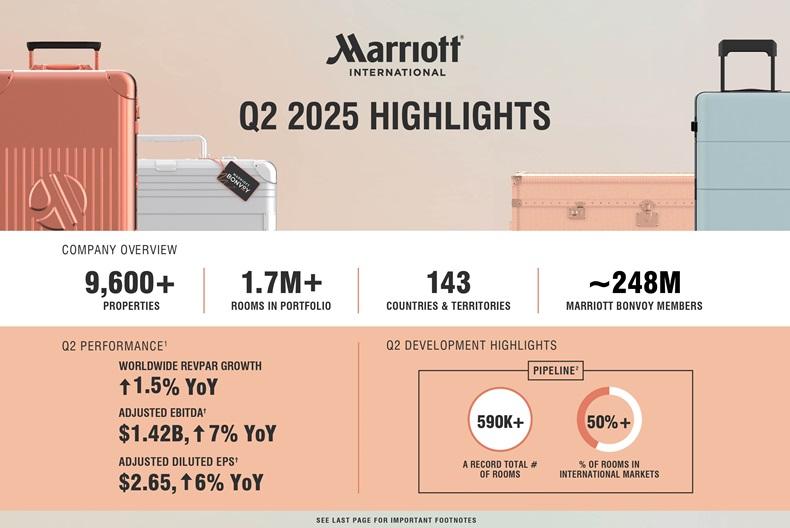

After rolling back the company’s guidance for future revenue per available room in May, Marriott International President and CEO Anthony Capuano reported “strong second-quarter financial results this morning, ahead of our previous guidance.”

During the quarter, worldwide RevPAR increased 1.5 percent (a 1.7 percent increase using actual dollars) compared to the 2024 second quarter. RevPAR in the U.S. and Canada was flat (a 0.1 percent decrease using actual dollars) year over year, and RevPAR in international markets increased 5.3 percent (a 6.1 percent increase using actual dollars) year-over-year.

Still, not all segments reported equally strong numbers. RevPAR for select-service and extended-stay hotels in the U.S. and Canada declined around 1.5 percent year over year in the quarter, Capuano said, crediting the drop to “a decline in government demand as two-thirds of government revenues are in the select-service segment, as well as weaker demand from smaller-business customers across chain scales.” Group RevPAR in the U.S. and Canada was also softer than previously anticipated, primarily due to fewer near-term bookings and elevated attrition rates, Capuano said.

CFO Leeny Oberg—who announced her planned retirement last month—said that globally, business-transient RevPAR was down 1 percent, while government-transient RevPAR was down 17 percent in the quarter.

Room Growth

The company added roughly 17,300 net rooms during the quarter, including more than 8,500 net rooms in international markets. At the end of the quarter, Marriott’s global system totaled over 9,600 properties, with approximately 1,736,000 rooms.

At the end of the quarter, the company’s worldwide development pipeline totaled 3,858 properties with more than 590,000 rooms, including 234 properties with over 37,000 rooms approved for development, but not yet subject to signed contracts. The quarter-end pipeline included 1,447 properties with more than 238,000 rooms under construction, including hotels that are in the process of converting to Marriott’s system. Over half of the rooms in the quarter-end pipeline are in international markets. The quarter-end pipeline does not reflect any rooms from the acquisition of the citizenM brand or from the launch of Series by Marriott.

Revenue, Income and Earnings

Marriott’s reported operating income totaled $1.23 billion in the 2025 second quarter, compared to 2024 second quarter reported operating income of $1.19 billion. Reported net income totaled $763 million in the 2025 second quarter, a 1 percent decrease compared to 2024 second quarter reported net income of $772 million.

Adjusted operating income in the 2025 second quarter totaled $1.18 billion, compared to 2024 second quarter adjusted operating income of $1.12 billion. Second quarter 2025 adjusted net income totaled $728 million, compared to 2024 second quarter adjusted net income of $716 million.

Adjusted earnings before interest, taxes, depreciation and amortization totaled $1.41 billion in the 2025 second quarter, a 7 percent increase compared to second quarter 2024 adjusted EBITDA of $1.32 billion.

Implementing AI

Responding to a question from Morgan Stanley’s Stephen Grambling, Capuano touted the company’s Marriott AI incubator that, he said, is working on “a variety of proof of concepts” in areas like reimagining the concierge function.

The company is also looking at piloting AI initiatives in its customer-engagement centers to help agents navigate the portfolio, Capuano continued. “We've incorporated AI into the Marriott Homes & Villas platform, and while it's early, the early reaction of our guests has been terrific,” he said. The company also launched an ambassador trip-planning tool that is fueled by AI. “So [there’s] lots of work going on in the AI space—but again, all of it focused on, number one, serving each of the constituents that we serve every day, and number two, creating capacities for our associates to better engage [with] guests.”

Outlook

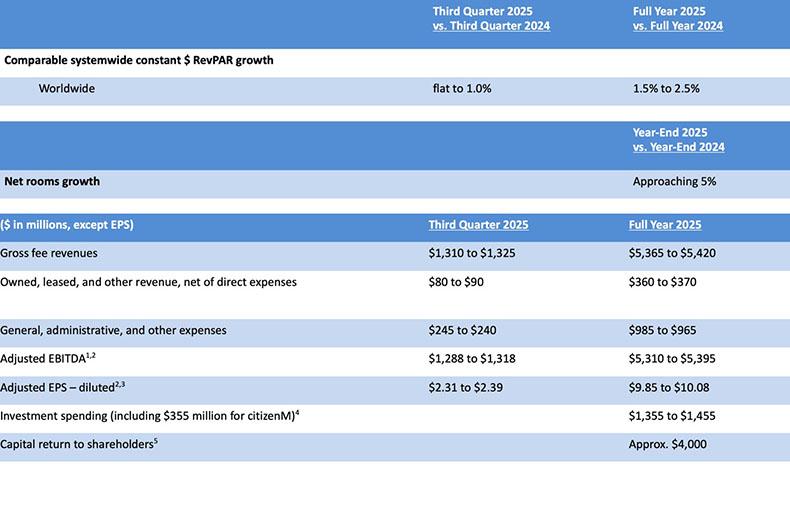

Acknowledging what she described as “ongoing economic uncertainty,” Oberg said the company expects global RevPAR to be flat to up 1 percent in the third quarter, and up 1.5 to 2.5 percent for the full year. “Our full-year RevPAR growth is still expected to be meaningfully stronger internationally than in the U.S. and Canada,” Oberg said. Ultimately, Marriott expects RevPAR to be fairly flat compared to last year, she continued. “The luxury and full-service segments—where we are extremely well positioned, accounting for over half of our open global rooms—are expected to continue to nicely outperform lower-end chain scales.”

Business transient RevPAR is now expected to be around flat year over year, with government demand expected to remain weak, Oberg continued. “Government room nights in the U.S. and Canada were down 16 percent year over year in the second quarter—more than in March—but do appear to have stabilized around these levels.”

Full-year adjusted EBITDA could increase between 7 and 8 percent to $5.3 and $5.4 billion.

Marriott’s strategy, Capuano said, is focused on keeping guests within the company’s ecosystem. “It is not adding brands for the sake of adding brands. It's not adding things like Homes & Villas, Outdoor Collection, Ritz-Carlton Yacht, simply to have stuff to talk about on the earnings call.” Instead, he said, the company is looking to understand what guests want in their trips and filling in whatever gaps take them to external businesses. “Irrespective of trip purpose, irrespective of destination, we have a platform that allows them to satisfy all their travel needs within that Bonvoy ecosystem without ever looking outside.”