After years of pandemic-driven disruption, RevPAR has largely returned to pre-2020 levels across many U.S. hotel markets, particularly those with strong leisure demand. This metric increased by 1.8 percent last year, with CoStar noting it reached $99.94. On top of this, CBRE projects a 2 percent growth in RevPAR for 2025, driven by modest increases in inbound international visitation, group demand and business travel.

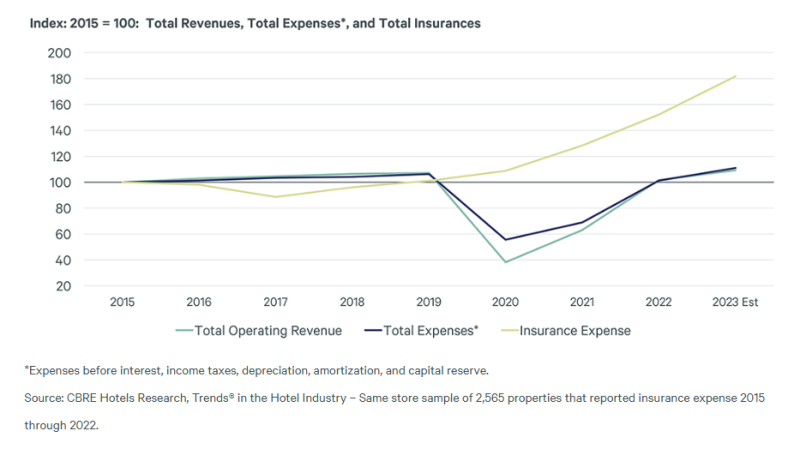

This should signal good news, but hotel investors aren’t breathing a sigh of relief yet. That’s because beneath the surface of this recovery lies a quieter, more insidious threat to profitability: insurance.

Fueled by climate volatility and dwindling carrier capacity, property insurance premiums for hotels have surged in some areas, noted Ryan Bosch, principal at Arriba Capital. Over the past 12 to 18 months, he has witnessed premium increases in the 5 percent to 15 percent range for most properties.

“That’s on top of the sharp jumps we experienced in prior years,” he explained. “In some high-risk markets, we’ve seen renewals spike 25 percent to 50 percent, impacting deal viability. Insurance has quietly become one of the most disruptive forces in hotel underwriting.”

Kimberly Gore, national practice leader of HUB International’s Hospitality Specialty Practice, has seen a similar increase based on the HUB 2025 Outlook Q1 Rate Report.

“There are several factors that have impacted rates, including weather-related events and building costs, insurance capacity, economic and legislative changes and increased litigation exposures,” she added.

The Quiet Margin Killer

Insurance is no longer a routine cost – it’s a deal lever. At least it is when rising premiums have the ability to reshape underwriting models, which then have the ability to throw off once-solid projections.

“It’s not just a line item anymore,” Bosch noted. “Insurance can swing a DSCR (debt service coverage ratio) or push a refinance below the debt threshold.”

Insurance has become a particular thorn in the side of DSCRs on assets with thinner margins or aging infrastructure. In terms of refinancing, Bosch has seen cases where insurance alone tipped the scale, determining whether owners secured full takeout or had to bring in cash to close.

“Some lenders are increasing insurance reserves or wanting more visibility into the borrower’s full insurance package,” he added.

Naturally, not all markets – or properties – are created equal.

“While there have been insurance premium increases nationwide, we find that assets located in areas of more frequent or increased risk are seeing higher-than-average premium increases year over year, in addition to more prohibitive and restrictive conditions on coverage,” said William Midtbo, partner at Prime Adjustments. “The rising premiums and restrictive policy provisions make decisions around whether to file a claim more difficult for hotel owners and managers.”

For Bosch, the biggest high-risk areas include coastal markets like Florida and parts of California, especially when builder’s risk coverage is required for ground-up projects.

“That’s where we’re seeing the ‘double whammy’: a high base cost for property insurance, and limited appetite among carriers to write builders' risk policies in those high-CAT (catastrophe) zones,” he explained. “In some cases, it’s taking multiple carriers to cobble together enough coverage, which complicates both timing and pricing.”

In California, insured losses from January’s wildfires are projected to hit $75 billion, with property losses alone expected to be in the $30 billion to $50 billion range, according to the HUB report. This may make it even harder (and more expensive) for properties in the West to get the coverage they need.

In Florida, Midtbo has witnessed the state-run insurer Citizens, which he describes as “an insurer of last resort,” decline coverage for historic properties, thereby limiting options for at-risk assets. Many policyholders must then resort to surplus lines insurance carriers, which provide coverage for risks that are too high or too unusual for standard insurance carriers to underwrite. The problem is these policies typically come with significantly higher premiums due to the increased exposure. Plus, if a loss does occur, the dispute resolution process can create extra challenges during the claim, Midtbo noteed.

Of course, losses don’t simply occur on the coasts. Gore would add the Carolinas, Gulf areas and Texas to the exposure hotspot list. She would also tack on Oklahoma, Missouri, Kansas, Illinois and Indiana as emerging geographies to watch.

“These Midwest areas have seen an increase in convective storms,” she explained. “Insurance companies have adapted their underwriting, pricing and risk management strategies in these areas.”

Certain asset features and amenities can also increase exposures and impact rates. For example, Gore noted resorts with large pools, slides and water features (especially water parks) are increasingly more difficult to insure. The same is true of spas offering medical-style treatments like Botox, laser services or anything in the anti-aging category, which often trigger added premiums and additional lines of medical professional insurance.

Carriers are also tightening the terms and conditions on liquor liability, human trafficking exposure and properties with children’s programs.

This increased scrutiny reflects a more cautious, conservative underwriting environment – and a growing buzzkill for lenders.

“We’ve seen a meaningful drop in carrier participation in certain markets, which is spilling over into lender sentiment,” Bosch said. “Even hotels with clean claims histories are feeling the impact because the broader risk environment is spooking underwriters. All of that is contributing to tighter reserves, more conservative debt sizing and longer closing timelines.”

To read the rest of the story, visit our sister site Hospitality Investor.